Shop Our Selection of HR Toolkits & Templates

Trusted by Businesses & HR Professionals in 87+ Countries

HR Resources

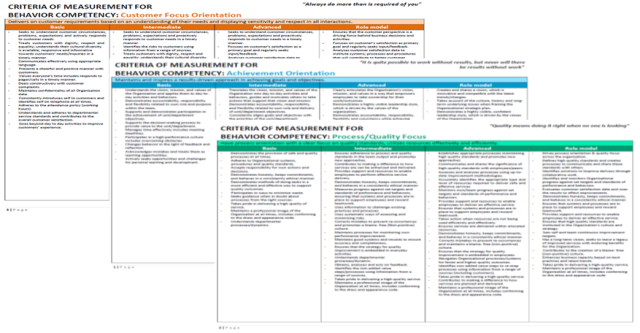

Behavioral Competency

$3.00

$3.00

Competency Dictionary

$10.00

$10.00

Succession Planning Manual

$25.00

$25.00

Job Analysis Toolkit

$7.00

$7.00

Job Leveling Framework

$3.00

$3.00

Recruitment Toolkit

$0.49

$0.49

Job Descriptions for more than 50 Jobs

$0.49

$0.49

Work from Home & Flexible Work Policy

$0.49

$0.49

HR Balanced Scorecard Toolkit

$0.49

$0.49

Human Resource Processes Manual

$5.00

$5.00

Performance Management Manual

$19.00

$19.00

Short Term Incentive Plan

$7.00

$7.00

Key Performance Indicators Dictionary

$3.00

$3.00

Business Processes, RACIs, and Interface Charts

$37.00

$37.00

Authority Matrix Template

$31.00

$31.00

Delegation of Authority Framework

$31.00

$31.00

International Schools Compensation Survey Report

$45.00

$45.00